The increased focus on renewable energy is already accelerating such changes. Technological developments and changes in resource distributions along the oil supply chain will also impact crude oil spot prices. Russia is a major global oil producer (12 % market share in 2020) & the EU’s main supplier of crude oil. The Russia-Ukraine war has impacted oil prices dramatically in 2022.The IEA expects crude oil consumption to be much lower in 2020. The 2020 outbreak of the COVID-19 pandemic saw crude oil plummet to a negative price per barrel.After the Iranian revolution in the late 1970s, the price of oil rose sharply.Many unforeseen events can also impact the price of crude oil, driving it up for down. Growth in transportation, petrochemical, and aviation industries.Įven though Organisation for Economic Cooperation and Development (OECD) countries are reducing their road transportation oil consumption on a per-vehicle basis, the growing automobile fleet in developing countries far outpaces such reductions.Increased energy consumption in developing countries.The International Energy Agency (IEA) predicted increasing global demand for crude oil back in 2019, due to: New sources can exert a downward force on oil prices, even in times of heavy demand.Įxtraction costs are typically higher for new resources, meaning these oils are only competitive in lower-supply, high-price environments.

New Resourcesįrom time to time new oil resources come online - like Canadian oil sands or US crude oil from oil shale - these add to the global supply. However, the global pool of oil and the ease with which oil moves around the world levels some of these price pressures, and no one oil producer to completely dominate the world market. The other main factors that affect oil prices include: Supply and DemandĪs with all commodities, oil prices are driven by supply and demand.

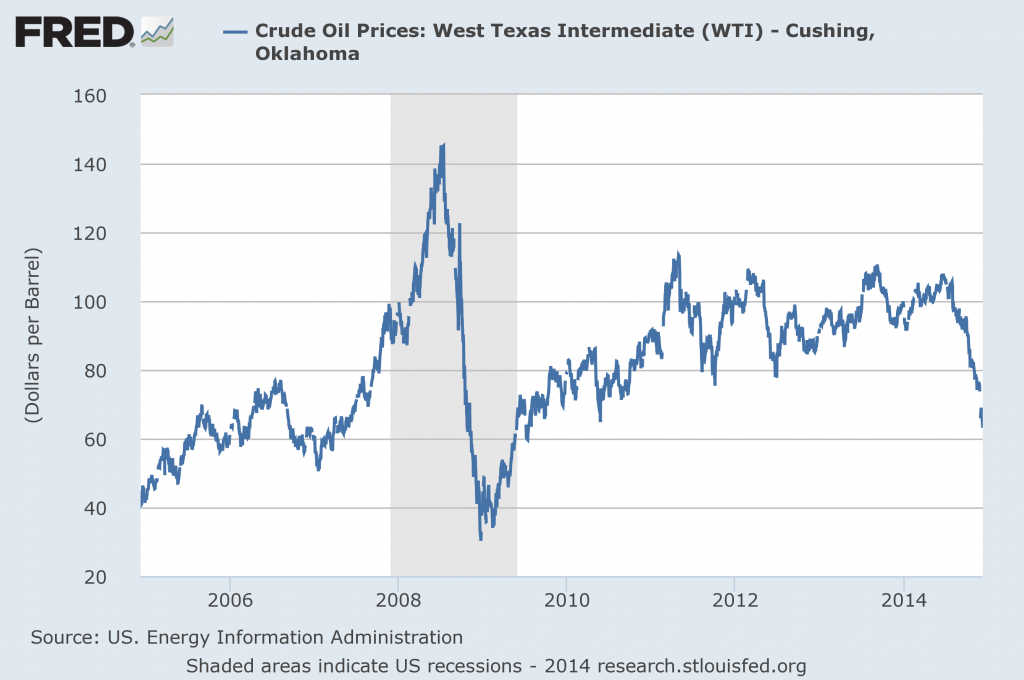

Oil prices are typically quoted per barrel - this is the same for the Brent crude oil spot price. The spot price indicates the cost at which Brent crude oil can be brought or sold. So, when you see a price tag named ‘Brent crude oil spot price’, it refers to the current market price of Brent blend crude oil. Spot price - the present price indicator at which an asset can be purchased or sold on the market.Crude oil - the physical asset being brought or sold, in this case, crude oil with minimal processing.Brent - the type of oil blend, as opposed to another oil blend like West Texas Intermediate (WTI).A simple way to understand oil spot prices is by breaking down the meaning of a complex term like ‘Brent crude oil spot price’:

0 kommentar(er)

0 kommentar(er)